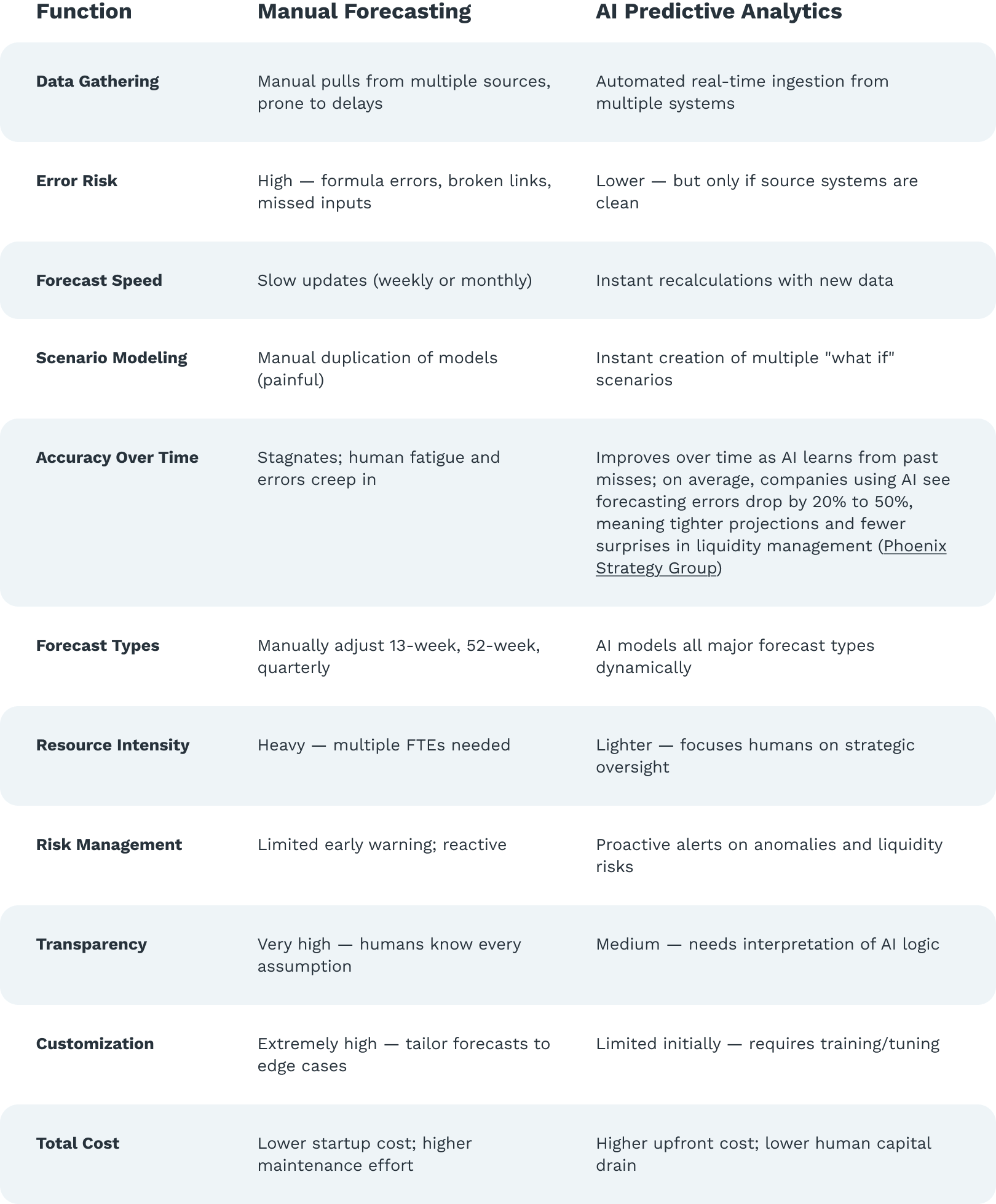

Manual or AI? Here’s How They Compare, Feature by Feature

If you're leading the charge behind your company’s treasury platform, you already know: forecasting cash flow is no longer a "nice to have" — it’s a daily business survival tool. The real question is:

Do you keep building forecasts manually — or do you trust AI predictive analytics to do it better?

The answer isn't black and white. It depends on what you're forecasting, how fast you're moving, and what kind of visibility your executive team demands. Let’s break it down with real-world nuance.

First, What Exactly Is AI Predictive Analytics for Treasury?

AI predictive analytics uses artificial intelligence and machine learning models to:

- Ingest data from ERPs, banks, TMS, CRMs automatically

- Recognize patterns faster than a human could

- Simulate future cash positions in real-time based on millions of variables

Instead of manually stitching together spreadsheets and asking business units for updated numbers, AI platforms aim to give you a living, breathing cash forecast that's always fresh.

AI cash forecasting platforms raise accuracy to 90–95% by analyzing global payables and receivables, giving treasury teams a clear edge in financial decision-making. (HighRadius).

Sounds perfect, right? Hold that thought.

Manual vs. AI: Real Feature-by-Feature Comparison

Where Manual Still Wins: Situations AI Struggles

That's not to say that manual forecasting is dead. There are places where human judgment — not machine learning — works better.

- BvA (Budget vs Actual) Reconciliations

- One-Off Events like M&A or lawsuits

- Direct Cash Flow Forecasting (daily inflows and outflows)

- Highly Regulated Environments

- Behavioral Factors like unexpected customer payment shifts

Manual judgment is still critical for nuance, and AI needs expert guidance.

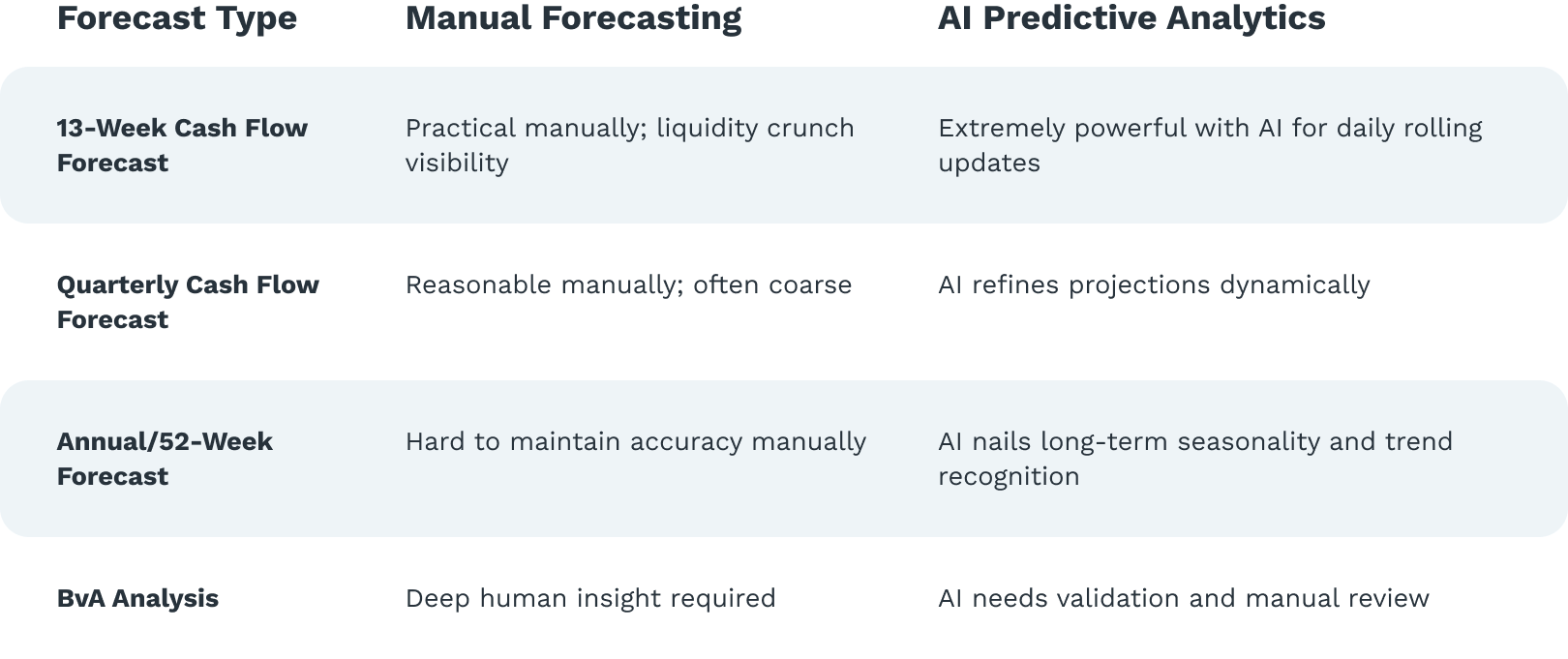

Types of Forecasts: How AI and Manual Stack Up

6 Key Factors Treasurers Must Weigh Before Making a Decision

If you’re sitting inside a finance team weighing options, here’s what matters most:

1. Business Complexity

- Low complexity (single entity, single currency)? Manual might be fine for now.

- High complexity (multiple legal entities, multi-currency, intercompany cash pools)? AI becomes critical to manage forecasting chaos.

Practitioner's Note: If you’re running multi-entity netting or FX hedging, manual forecasting can’t keep up without significant risk exposure.

When companies use AI to manage deals with their suppliers (like paying for goods and services), they free up about $55 million in extra cash for every $1 billion they make. (Phoenix Strategy Group)

2. Growth Velocity

- Predictable, slow-growth company? Manual methods stay manageable.

- Hypergrowth (new markets, M&A)? You’ll drown in spreadsheets unless you have AI automation to adjust dynamically.

Treasurer's note: Growth multiplies forecasting complexity. One acquisition = 5x the work manually.

3. Risk Tolerance

- Comfortable with minor surprises? Manual might cut it.

- Zero tolerance for liquidity surprises (e.g., public companies, PE-backed firms)? AI predictive alerts are essential.

Practitioner's note: Board committees now expect rolling 13-week forecasts in minutes, not weeks.

4. Treasury Talent and Bandwidth

- Large, highly experienced treasury department? Manual muscle memory can cover gaps.

- Lean team, stretched across cash, banking, investments? AI will protect against burnout and human error.

Treasury leader’s note: Manual forecasting chews up FTE hours that should be spent on yield optimization and working capital strategy.

5. Investment Appetite

- Minimal budget or high internal IT barriers? Manual it is (for now).

- Strategic investment mindset? AI’s upfront costs pay off exponentially with accuracy, speed, and risk reduction.

Practitioner's note: AI investment often unlocks faster closes, better working capital days, and real FX cost reductions — things CFOs love.

6. Strategic Timeline

- No immediate major events? Manual may suffice for 6–12 months.

- Upcoming debt refinancing, IPO, or PE exit? You need real-time cash visibility today, not next quarter.

Treasurer's note: AI’s true value often shows up during “events” — like covenant compliance, rating agency reviews, or merger diligence.

The Bottom Line:

AI predictive analytics is not magic.

It’s not replacing treasury experts.

It’s amplifying their power.

- Manual forecasting remains critical for special cases, direct daily receipts/disbursements modeling, and judgment-based adjustments.

- AI forecasting is unbeatable for dynamic, multi-scenario, rolling cash visibility across growing businesses with real risks and regulatory expectations.

As a practitioner, your real job is to orchestrate both:

- Let AI handle the volume, the math, the pattern recognition.

- Let human treasury experts handle strategy, judgment, and exceptions.