Stay Informed and Stay Ahead

Stay updated with the latest Treasury4 features, improvements, and enhancements in our platform.

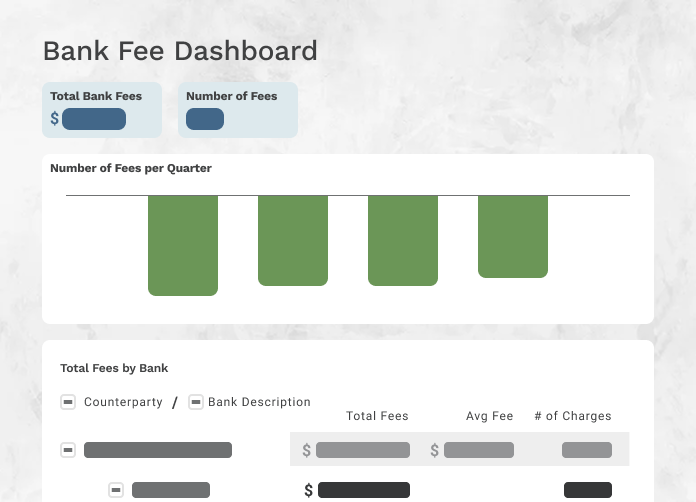

Bank Fee Analytics

Bank Fee Analytics (BFA) gives Treasury4 users powerful visibility into banking costs by automatically importing, standardizing, and analyzing Account Analysis (AA) statements across institutions. By mapping fees to standard AFP codes and surfacing insights through dashboards and benchmarking tools, BFA helps uncover redundant charges, optimize fee structures, and reduce manual reconciliation effort—ultimately driving cost savings and improving vendor oversight.

Manual Import of Projected and Forecasted Items

Entity Groups

Organize entities into groups by fund, project, etc., for easy filtering and relationship insights.

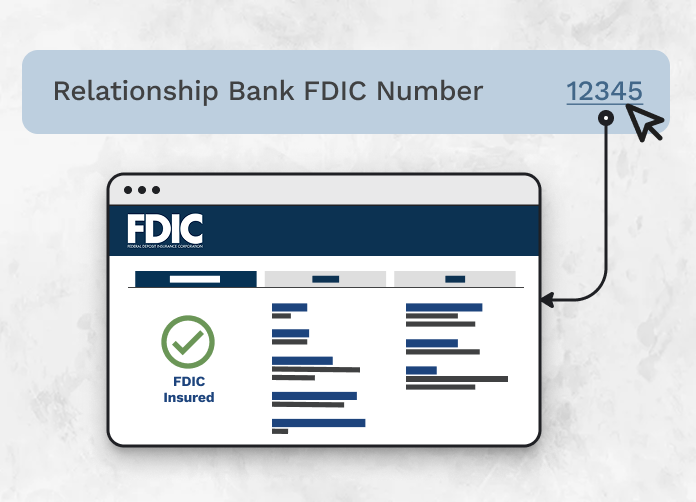

FDIC Institution Link for Relationship Banks

When viewing a Structured Liquidity Product holding, users can now click the Relationship Bank’s FDIC number to navigate directly to the FDIC Institution Details page—providing quick access to official bank information for added context and verification.

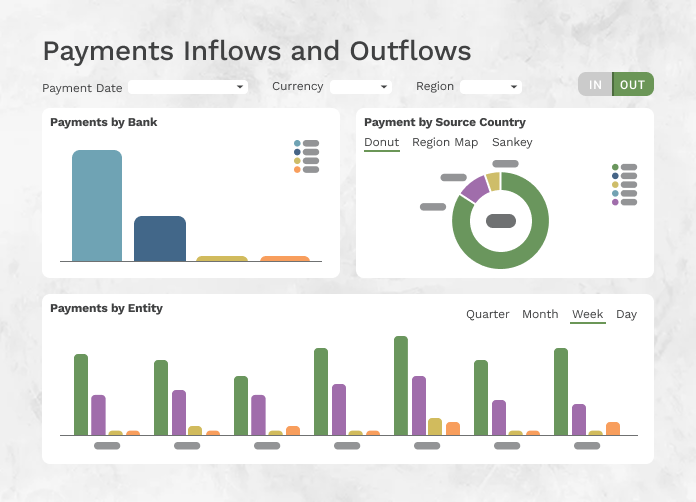

Payment Outflows Report

Object Tags

Tag records for quick access and easier collaboration.

IntraFi Integration for Structured Liquidity Products

Treasury4 now supports automated integration with IntraFi files, enabling seamless import of structured liquidity product data. This reduces manual effort, ensures timely updates, and improves visibility into IntraFi positions directly within Treasury4.

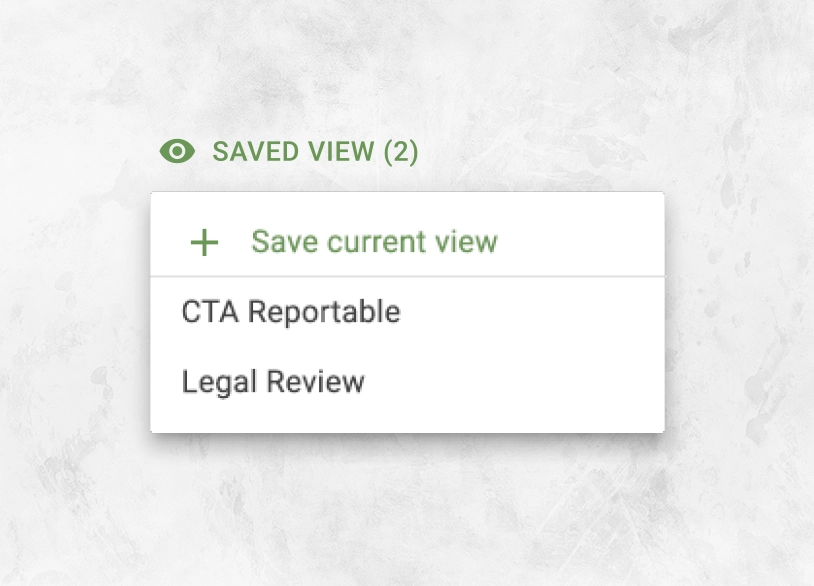

Saved Views

Customize and save table views to suit your needs and quickly filter records.

Excited to Learn More?

Reach out and let's get connected!