Predictive Cash Forecasting: Why It’s Worth the Switch — And How to Get CFO Buy-In

There's a real shift happening right now in the treasury world— moving from legacy cash forecasting tools (built for static reporting) to predictive platforms (built for live, dynamic decision-making). This is about protecting liquidity, strengthening risk posture, and giving treasury a bigger seat at the strategy table.

tl;dr: What Are the Benefits of Predictive Cash Forecasting vs. Legacy Tools?

- Predictive platforms update forecasts in real time using live operational data, not static historical inputs.

- They support instant scenario modeling to simulate market shifts, payment delays, or major financial events.

- Treasury teams can build and adjust reports directly—no IT tickets or long wait times.

- Liquidity tiering shows clearly segmented views of available vs. restricted cash.

- Direct cash flow statements align with complex structures across entities and regions.

- AI-driven models improve accuracy over time, reducing forecasting errors by 20–50%.

- Predictive forecasting gives CFOs faster, more confident visibility to support strategic decisions.

If forecasting feels too slow, too manual, or too disconnected — this is worth your scroll.

So if you're wondering whether switching is worth it or how to make the case to your CFO, here’s a real-world look at why it’s the smart move.

Why Legacy Cash Forecasting Tools Are Struggling

Most traditional treasury systems — Kyriba, HighRadius, Anaplan, even major ERPs — were built in a different era of treasury.

An era where:

- Cash forecasting was an add-on, not the core.

- Forecasts refreshed quarterly, sometimes monthly, almost never daily.

- Treasury’s job was to "keep the lights on," not drive strategic cash deployment.

Some of today's leading platforms are good at cash positioning — but less effective at helping you answer critical forward-looking questions like:

- How would a 5% drop in receivables impact our liquidity in 60 days?

- Can we model a refinancing event across multiple banking relationships instantly?

- What happens to free cash flow if supply chain payments extend by 15 days next quarter?

Legacy systems weren’t designed for real-time scenario planning or predictive adjustments based on operational signals. They can tell you where you are, but they struggle to tell you where you’re headed.

What Predictive Cash Forecasting Brings to the Table

1. Scenario Planning That’s Actually Fun (Yes, Really)

Remember when building a cash scenario meant creating six versions of the same spreadsheet, half of which had broken links? Good times. Modern platforms make scenario planning a completely different experience. You can tweak assumptions, move sliders, and instantly see the effects. It's a bit like those old "choose your own adventure" books — except instead of getting eaten by a dragon, you’re mapping out how to extend your cash runway by sixty days.

Wondering what happens if receivables slow down in Europe or if your next acquisition closes early? Test it in minutes. Build, compare, tweak again. It’s flexible, fast, and — dare we say it — kind of satisfying.

2. Always-On Forecasting With Real-Time Signals

Modern treasury solutions treat forecasting more like a living, breathing thing. They pull in real-time signals — like billing cycle shifts, sales pipeline updates, and receivables trends — to keep the forecast evolving naturally.

Instead of asking, “Where were we last month?” you’re answering, “Where are we going next?” It’s the difference between checking a weather report from last week versus looking out the window right now.

For practitioners who work fluently across business intelligence platforms and structured datasets, automated forecasting and trend analysis opens an even bigger door. Treasury teams can solve unstructured problems faster, running real-world scenario simulations that don't just report the past — they support proactive planning, risk modeling, and better alignment with executive strategies.

For a broader industry take on how predictive analytics is shaping the future of cash flow forecasting, this overview shows how AI is being applied to forecasting processes and how to adopt it to increase accuracy and decision-making speed.

3. Open Data Architecture That Doesn’t Box You In

In the past, accessing treasury data often meant delays, limitations, and disconnected systems. Today’s cash and treasury platforms are built on open, flexible architecture, where data moves both ways — easily pushed, pulled, enriched, and reused wherever it’s needed. Teams gain fast access to reliable information, with full visibility across systems, entities, and timeframes.

Everything talks to everything else: ERPs, TMS platforms, CRM systems, banking feeds. No more rigid data bottlenecks, and definitely no more locked-in silos.

Modern platforms are designed to meet treasury experts where they already live — across trusted analytics environments and reporting systems. That means pre-built visualizations, direct access to curated treasury datasets, and scalable architecture that grows alongside your needs, not against them.

4. Treasury-Led Reporting (No Service Tickets Required)

Waiting three weeks for IT to run a report you needed yesterday? That’s a story for the grandkids. Modern treasury and cash solutions put curated data and intuitive templates directly in your hands, so you can build what you need when you need it.

Want to build a dashboard showing cash forecasts across all entities? Use preconfigured templates to filter by entity, currency, or region, and publish views for finance and executive teams in minutes. Need to model a new debt facility or funding round? Adjust the inputs directly—no need to submit a request or wait for engineering. Treasury teams can access curated datasets, update parameters, and generate updated reports in real time, all from the same interface.

5. Direct Cash Flow Statements, Built for Complex Companies

Running treasury for one company is tough enough. Add multiple subsidiaries, acquisitions, and cross-border operations, and things can get messy fast. Modern cash and treasury platforms are ready for that. They offer direct cash flow statements with hierarchical structures that naturally align to accounting standards, so you’re not reinventing the wheel every time a new entity joins the fold.

For private equity-backed firms, high-growth companies, or multinational groups, this kind of structure makes a world of difference. You stay organized, confident, and ready to answer when leadership says, “Can you show me cash flows broken down by business unit?” without breaking a sweat.

6. Liquidity Tiering: Seeing Cash in Full Color

Not all cash is created equal. Some are locked behind covenants, some tied to subsidiaries, and some ready for deployment tomorrow. Modern treasury platforms bring liquidity tiering into the spotlight, giving clear, layered views of cash across restricted, committed, and available categories.

Instead of guessing at how much working capital you really have on hand, you see it clearly. You can support long-term planning, smarter investment timing, and better capital allocation without spinning up a dozen side spreadsheets. It’s the financial equivalent of finally getting a color-coded map after years of navigating with a grayscale printout.

How It All Ties Together: Treasury-Led Growth

Modern treasury and cash platforms give us a completely different way of operating.

When you have real-time data flowing freely, forecasting that evolves automatically, and the ability to test big strategic moves instantly, treasury becomes a strategic growth engine. You’re not waiting for information; you’re steering the conversation. You’re not building static reports; you’re shaping business strategy in real time.

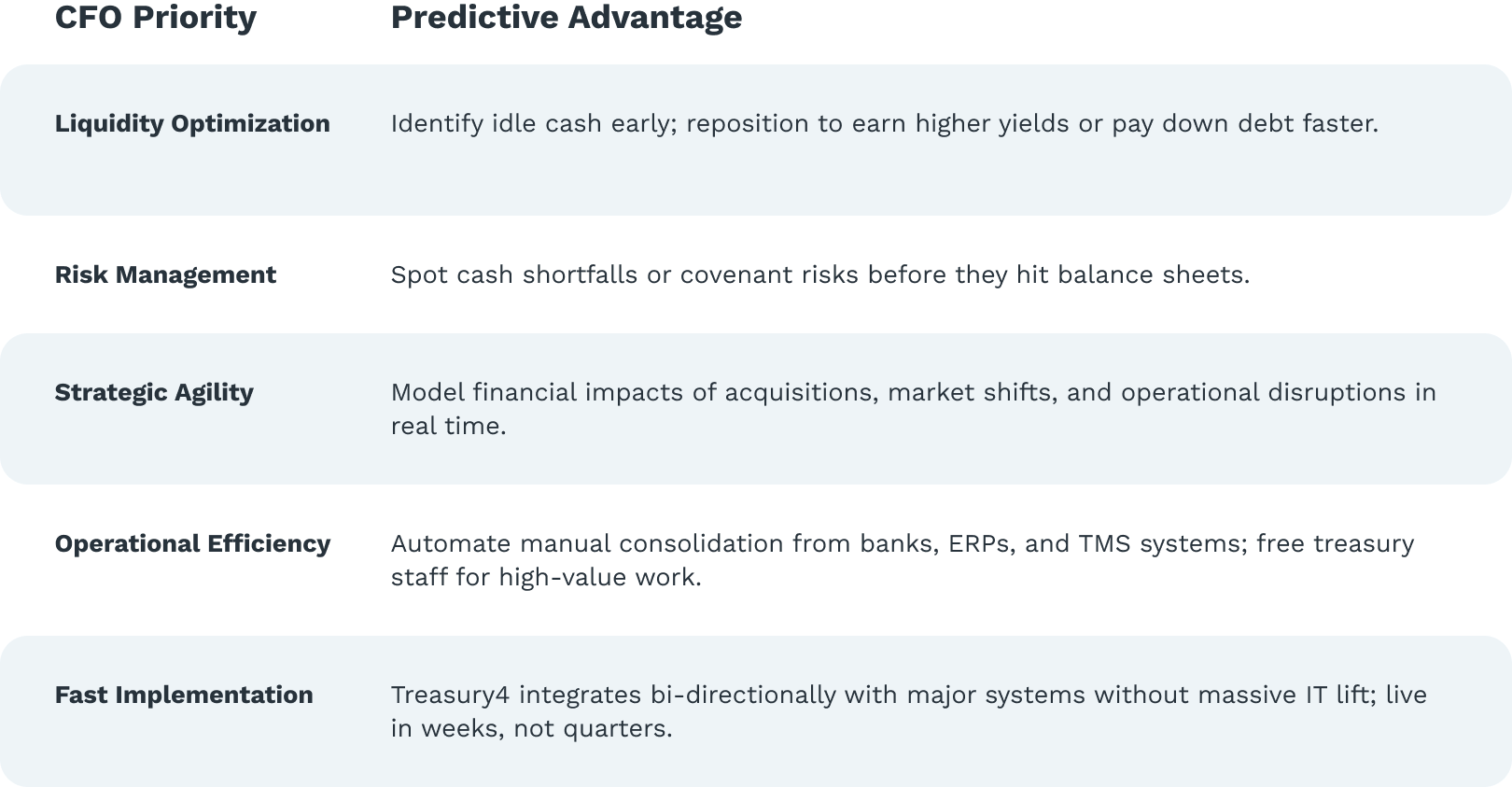

The CFO Perspective: What Decision-Makers Care About

One of the biggest roadblocks treasury teams hit isn’t seeing the value themselves — it’s getting buy-in from the CFO or executive leadership.

CFOs generally aren't evaluating "features." They’re thinking about outcomes:

- Can we optimize liquidity better?

- Can we reduce financial risk?

- Can we make faster, more confident capital decisions?

- Will this be a nightmare to implement?

Here’s how predictive cash platforms help answer those concerns.

If you frame the conversation around risk, liquidity yield, agility, and efficiency, you’ll resonate much more than just talking about "new features."

Why Staying with Legacy Tools Isn't "Safe" Anymore

It’s tempting to think, “Well, our current system isn’t perfect, but it works,” but here are some risks worth thinking about.

- Static forecasts leave you flying blind during market shocks.

- Manual processes tie up treasury bandwidth when you could be working strategically.

- Missed liquidity optimization costs real money in net interest margins, investment returns, and cash flow positioning.

A study by the International Institute of Forecasters found that companies using predictive analytics in their forecasting processes achieved a 10-20% improvement in forecast accuracy compared to those using traditional methods. (Source)

Those numbers move the needle — and CFOs notice.

How to Approach the Conversation with Leadership

When you're ready to make the case for switching, here’s a practical approach:

1. Quantify the Opportunity

If your team can save even 30–50 bps (basis points) of improved liquidity yield, that’s real cash.

Model what a 1–2 day improvement in DSO or DPO would mean for working capital.

Bring numbers. Bring examples.

2. Focus on Strategic Outcomes

Position treasury as a growth enabler, not just a cost center.

Predictive forecasting supports better M&A timing, stronger cash yield strategies, faster crisis response — all things the CFO cares about at a board level.

3. De-Risk the Transition

One major fear leadership has is implementation disruption.

Highlight that predictive platforms like Treasury4 are modular, cloud-native, integrate easily with ERPs and TMS systems, and can be layered into existing environments without "ripping and replacing" everything.

Deployment isn’t a massive two-year project. It’s 8–12 weeks to live cash forecasting.

What to Look For in a Predictive Cash Platform

If you’re evaluating options, here are key things to prioritize:

- Forecasting-First Architecture: Cash visibility shouldn’t be a side feature. It should be the foundation.

- Predictive Data Models: Leading indicators, operational inputs, AI-enhanced adjustments.

- Real-Time Scenario Planning: Not just modeling — true dynamic updating based on inputs.

- Flexible Integration: ERP, TMS, CRM, banking APIs — no isolated silos.

- Ease of Use: Built for treasury teams to run themselves, without constant IT support.

- Deployment Speed: If it’s going to take a year to implement, it’s already outdated.

The cash and treasury platform you'll want is built with exactly these principles because it was designed by practitioners who lived the pain points — and knew the future had to look different.

Final Takeaway: You Can't Forecast the Future With Yesterday’s Tools

When the CFO, the CEO, or the board asks, “How much cash will we have in 90 days?”,

you either have real answers — or you’re making educated guesses.

Legacy tools can give you visibility. Predictive platforms give you control, and control over liquidity is control over opportunity. Switching leading treasury into the future — and making your team indispensable along the way.