Excel vs. Cash & Treasury Platforms: A Practical Comparison

Every company and every team operates at a different level of complexity, maturity, and resource availability. For some, Excel remains sufficient. For others, it’s become a constraint. So we've put together a straightforward, honest review.

In This Article

Not sure if Excel is still enough or what a platform would really change?

This guide breaks down the core areas of treasury work—cash, reporting, and forecasting—and shows how Excel compares to modern platforms in each. Clear, practical, and written by former practitioners.

We focused on the key responsibilities treasury and finance teams manage daily—reporting, forecasting, cash visibility, scenario planning—and evaluated how each platform supports those tasks. The goal isn’t to promote one approach over another, but to give you a clear perspective for both platforms.

This comparison was developed by our experts—former treasurers, CFOs, and finance practitioners—who’ve worked in both Excel-based workflows and system-enabled treasury environments. It’s intended to help you evaluate your current approach and understand what may need to evolve as your business grows.

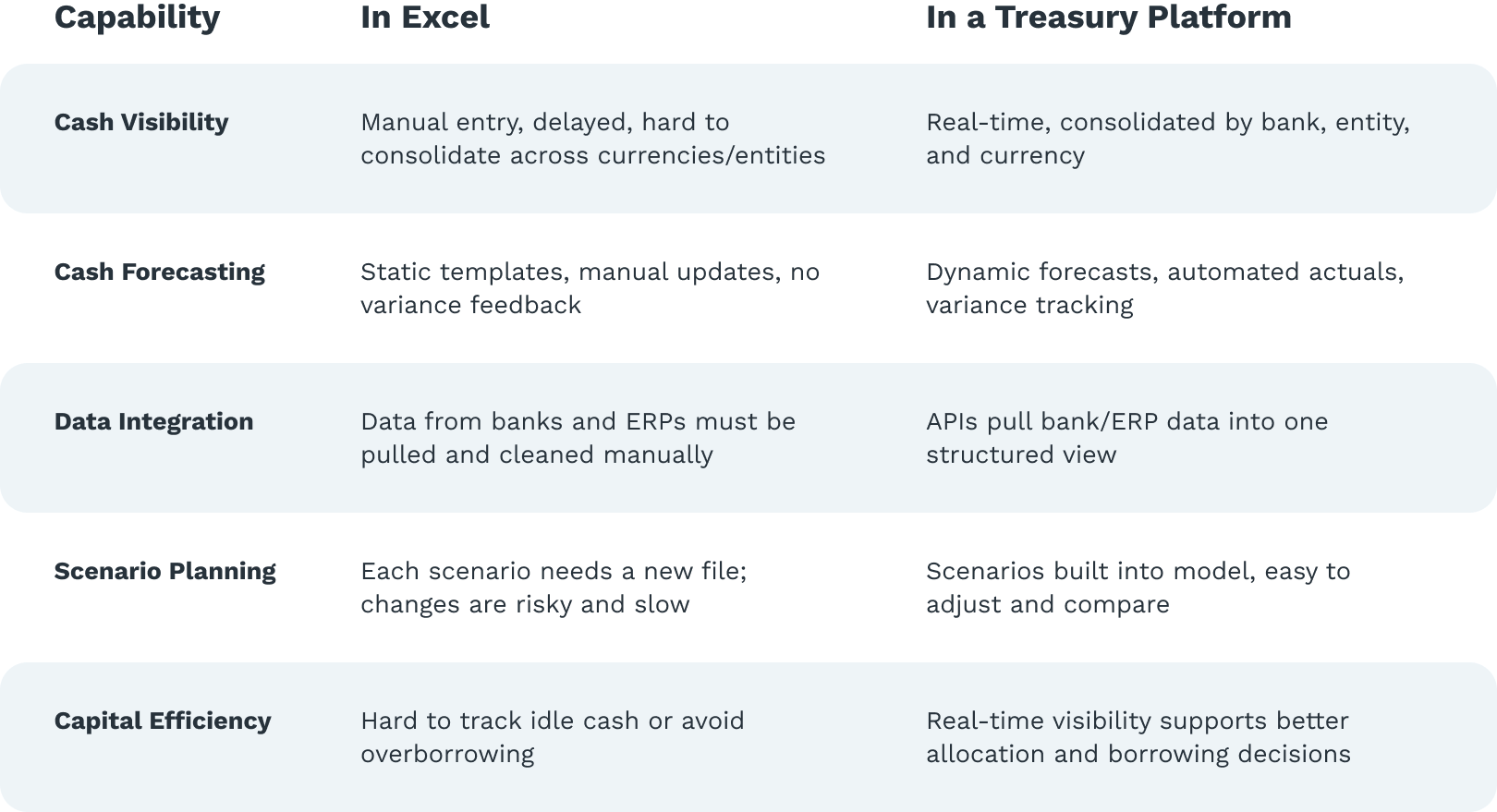

Cash Management

Cash remains one of the most scrutinized, yet least reliably understood, aspects of financial operations, especially in fast-moving or multi-entity environments. Below are the core challenges finance and treasury teams face, with a comparison of how they play out in Excel versus a modern cash and treasury platform.

Keep reading to see how these capabilities work in practice and why they matter when you're managing cash across a growing, complex business.

Cash Visibility

Teams often struggle to get a consolidated, up-to-date picture of available cash across accounts, regions, and entities. When data comes from multiple bank portals or is shared via email, the risk of delay and inaccuracy is high. Here's a quick breakdown:

- In Excel: Visibility depends on manual data entry from various sources. Prior-day balances must be pulled from statements, and there’s no real-time insight. Consolidation is slow and error-prone, especially with multiple currencies or legal entities.

- In a Cash and Treasury Platform: Real-time or near-real-time balances are pulled via API across all connected banks. Dashboards present global cash by entity, currency, or region instantly. Teams can respond faster, and CFOs don’t have to wait for answers.

Cash Forecasting

Treasury teams rely heavily on short-term cash forecasts, but accuracy often degrades over time without automated adjustments. Static assumptions and delayed inputs make it difficult to trust or refine projections.

- In Excel: Forecasts are built using past templates and assumptions, with manual inputs and little feedback from actuals. Over time, variances accumulate, but there’s no automated way to adapt the model.

- In a Cash and Treasury Platform: Forecasts update dynamically as actuals come in. Variances are tracked automatically, and patterns are flagged for review. Historical trends inform future projections, and forecast accuracy improves over time.

Data Integration

Data needed for cash visibility and forecasting lives in multiple systems—bank portals, ERPs, AP/AR modules—and rarely connects cleanly. This creates delays and reduces trust in the numbers.

- In Excel: Multiple files from different sources must be downloaded, reformatted, and consolidated by hand. There’s no automatic linkage, so every step is manual—and prone to error.

- In a Cash and Treasury Platform: Bank data, ERP feeds, and internal forecasts connect through integrations or APIs. The data environment is structured, centralized, and ready for analysis without rework.

Scenario Planning

CFOs increasingly rely on treasury for “what if” insights, but most teams aren’t equipped to answer quickly. Scenario modeling needs to be responsive and trustworthy, especially in volatile markets.

- In Excel: New scenarios require duplicating models and editing inputs across tabs or files. The risk of breaking something rises with each version. Sensitivity analysis is time-consuming and hard to update.

- In a Cash and Treasury Platform: Scenario logic is built into the forecast. Assumptions can be adjusted in a controlled environment, and impacts are visible immediately. Multiple scenarios can be saved, compared, and shared with leadership.

Capital Efficiency

Without precise data and forecasting, companies often hold too much idle cash or borrow unnecessarily. Poor cash utilization translates into missed opportunities or added cost.

- In Excel: It’s difficult to track where cash is truly available or restricted. Idle balances can go unnoticed, and borrowing may happen even when internal liquidity exists elsewhere.

- In a Cash and Treasury Platform: Cash availability is visible in real time, and idle balances are easy to identify. Borrowing needs can be forecasted more accurately, and investment or sweep opportunities are surfaced automatically.

Treasurers often find themselves buried in reconciliations instead of answers—this deep dive breaks down why even the best practitioners struggle with basic cash questions, and what structural changes actually fix it.

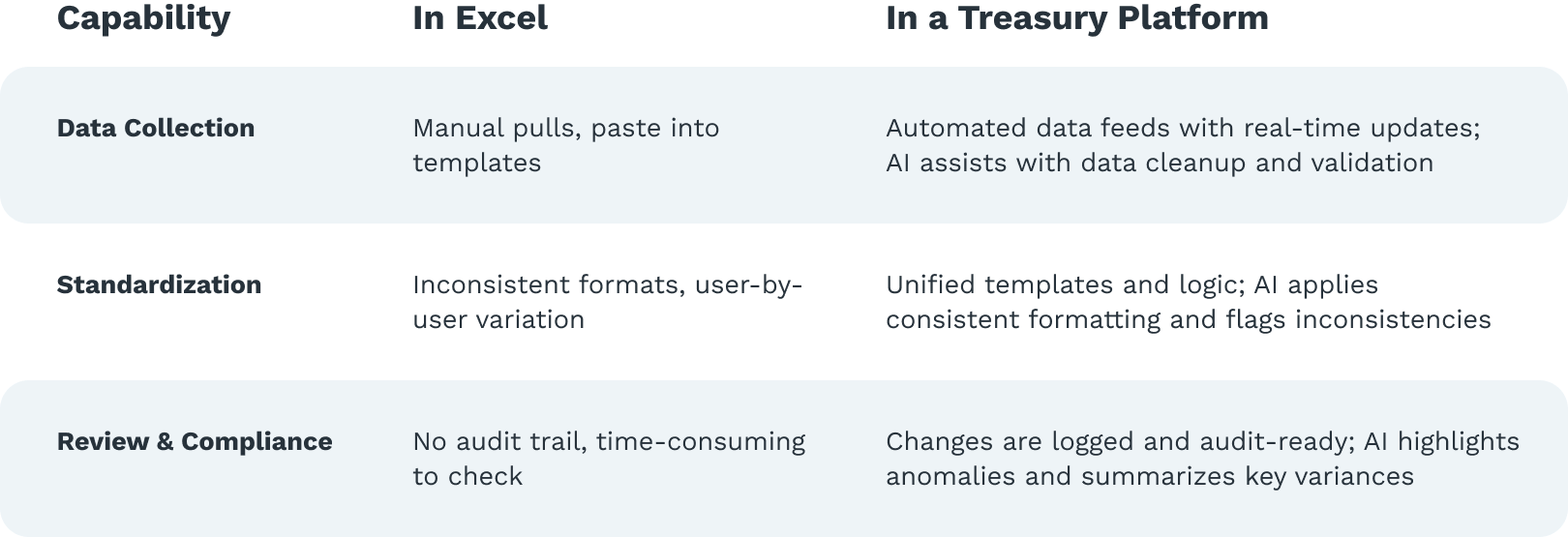

Reporting

Reporting is a foundational part of treasury’s role, supporting everything from cash visibility to executive communication. How reports are built, maintained, and shared has a direct impact on both accuracy and agility and increasingly, AI plays a role in enhancing all three.

Here's how key aspects of reporting differ between Excel and a modern cash and treasury platform.

Data Collection and Consolidation

Treasury reports often require data from multiple systems—bank portals, ERP modules, AP/AR systems, and internal trackers. How that data is gathered can shape both speed and reliability.

- In Excel: Bank balances, transactions, and forecast inputs are gathered manually and copied into spreadsheets. Each reporting cycle requires repeated effort to compile and clean the data.

- In a Cash and Treasury Platform: Bank and ERP data is pulled automatically via integrations. AI enhances this process by cleaning data, flagging outliers, and validating completeness, so reports populate in real time with cleaner, more consistent data—reducing manual oversight.

Standardization and Consistency

Treasury reports must be accurate and repeatable, especially when shared across teams or reviewed by executives.

- In Excel: Templates and formats may vary by user. Definitions, assumptions, and timelines are not always aligned. Teams often rely on informal handoffs and versioning.

- In a Cash and Treasury Platform: Templates and logic are standardized across users. Reports follow consistent naming conventions, business rules, and calendar logic.

Review and Compliance Readiness

Treasury reports often inform disclosures, credit decisions, or board-level conversations. They must stand up to scrutiny.

- In Excel: There is no built-in audit trail. Reviewing formulas and assumptions requires manual tracing. Review cycles are time-consuming.

- In a Cash and Treasury Platform: All changes are logged and traceable. Reports reflect the full chain of inputs and calculations, increasing confidence in decisions and disclosures.

Forecasting

Forecasting is where treasury connects operational data with forward-looking decision-making. It informs liquidity planning, capital structure, and risk management—and directly supports CFO-level conversations. How forecasts are built, updated, and evaluated determines how confidently an organization can plan ahead.

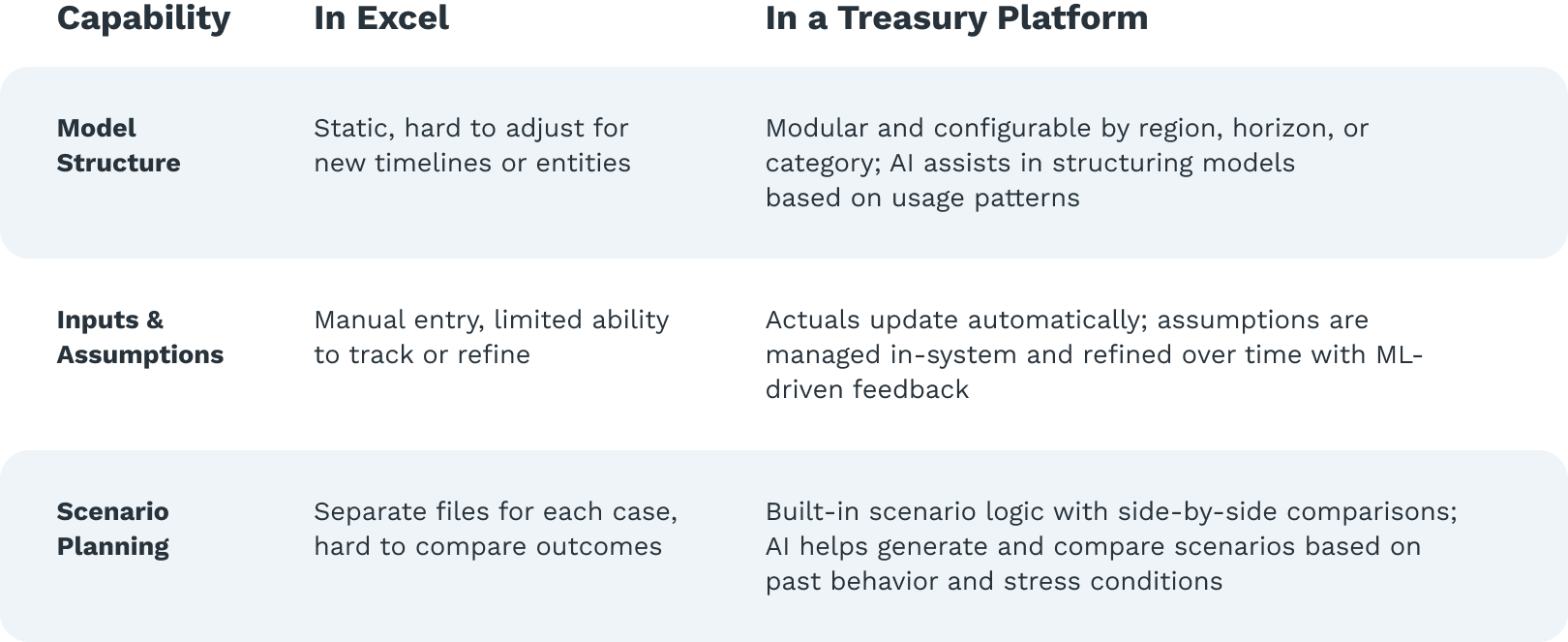

Take a closer look at how forecast structure, inputs, and scenarios perform across both tools.

Forecast Model Structure

A forecast’s structure—whether direct or indirect, short-term or rolling—needs to align with business needs and be flexible enough to adjust as those needs evolve.

- In Excel: Forecasts are typically static and built for specific time horizons (e.g., 13-week cash flow). Adjustments require manually updating formulas, timelines, and assumptions. Structural changes can break the model.

- In a Cash and Treasury Platform: Forecasts are modular and configurable. Users can build by region, entity, or category and adjust horizons as needed—daily, weekly, or monthly—without rebuilding templates. Machine learning models enhance the structure by capturing volatility and evolving patterns, helping forecasts stay responsive even in uncertain conditions.

Data Inputs and Assumptions

Forecasting depends on timely, reliable inputs—from actuals, AP/AR pipelines, and other operational data.

- In Excel: Inputs are pulled manually from ERP systems or internal trackers. Variances between forecast and actuals are calculated manually. There’s no automation to compare or refine assumptions over time.

- In a Cash and Treasury Platform: Actuals flow in automatically. Forecast assumptions can be tied to business drivers (e.g., DSO, vendor payment terms) and are updated regularly. The system tracks accuracy and highlights variances.

Scenario Planning

Leadership often asks for “what if” views on cash under different conditions—new funding, acquisitions, delayed receivables, or unexpected expenses.

- In Excel: Each scenario requires duplicating the model or creating separate versions with adjusted inputs. There's a high risk of formula drift or misalignment. Comparing outcomes is manual.

- In a Cash and Treasury Platform: Scenarios are layered directly into the forecast model. Users can adjust drivers or assumptions and compare outcomes side by side, without breaking the base model.

Final Takeaway

Excel has served treasury and finance teams well for decades. It offers flexibility, transparency, and control, and for many organizations, it still meets the need. But as reporting cycles tighten, entity structures grow more complex, and decisions depend on faster insights, it’s worth asking whether the tools you rely on are keeping pace.

This comparison is about helping you see clearly where Excel is still effective, and where modern platforms can reduce manual effort, improve accuracy, and support more confident decision-making.

Every team’s path looks different. Whether you’re evaluating a shift or simply taking stock of what’s possible, we hope this guide gives you a useful starting point.