Posts by Dona Bhattacharjee

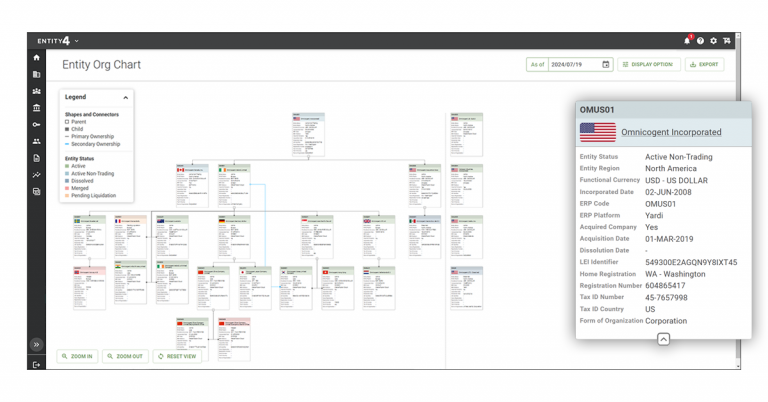

Entity4: An Essential Tool for Entity Management and a Strong Treasury Tech Stack

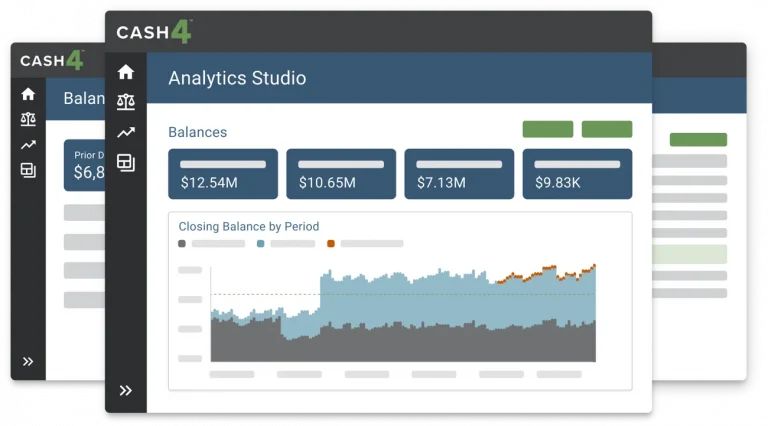

The role of the treasurer has grown and evolved significantly in recent years. In addition to managing the company’s bank accounts and maintaining accurate financial reporting, treasurers are now also responsible for legal entity management, regulatory compliance, data-driven forecasts, strategic decision-making, and more. To manage these various, complex duties, it’s crucial to build a strong…

Read More7 Tricks of the Trade to Enhance Your Cash Reconciliation Process

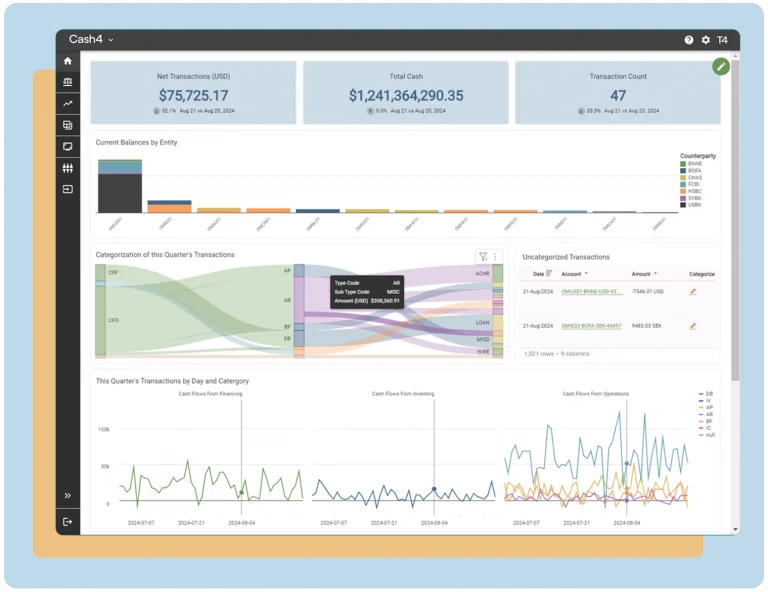

Treasury professionals know that cash reconciliation is an essential part of cash flow management for any organization. It shows the company’s cash position, identifies errors or fraud, and allows management to make informed, strategic decisions based on the most up-to-date information. Unfortunately, the cash reconciliation process comes with several common hurdles that CFOs and treasurers must…

Read MoreTreasury4 Joins U.S. Bank Connected Partnership Network

Partnership will deliver API-based data integrations of U.S. Bank balance, transaction, and investment data through Cash4 for mutual customers of Treasury4 and U.S. Bank June 19, 2024 09:00 AM Eastern Daylight Time SPOKANE, Wash.–(BUSINESS WIRE)–Treasury4, an enterprise software platform offering modern tools for treasury and finance practitioners, announced today that it is joining…

Read MoreTreasury4 Joins J.P. Morgan Payments Partner Network

Mutual clients to benefit from API-based data integrations of J.P. Morgan and Morgan Money cash and investment data through Cash4 September 17, 2024 09:00 AM Eastern Daylight Time SPOKANE, Wash.–(BUSINESS WIRE)–Treasury4, an enterprise software platform offering modern tools for treasury and finance practitioners, announced today that it has joined the J.P. Morgan Payments Partner…

Read MoreWhy You Should Treat Legal Entity And Other Non-Financial Data Like Financial Data

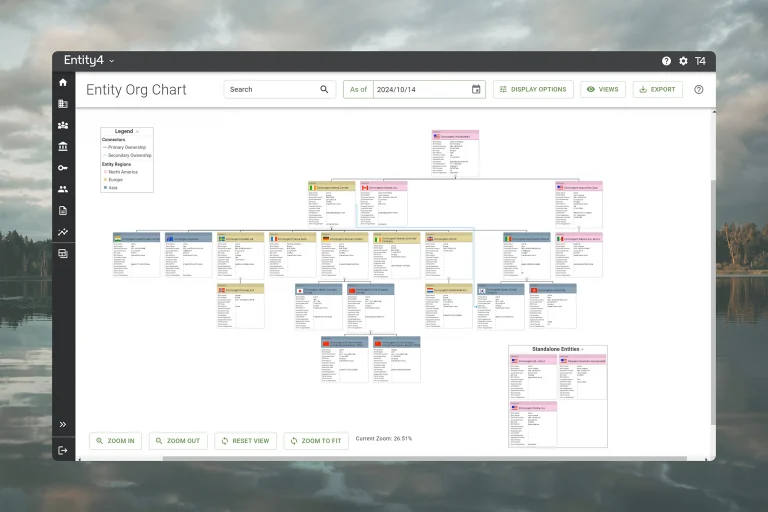

Steve Helmbrecht No two organizational structures are equal. Every organization has a distinctive legal entity structure. This can include parent entities, subsidiaries, partnerships, limited liability companies, joint ventures, and other related entities. It’s critical for key players to get a centralized view of this information to understand how their organization is structured—and how the…

Read MoreBeyond the Basics: Why Modern CFO Offices Need More Than a Regular TMS

The role of the chief financial officer (CFO) has evolved dramatically in recent years. While the CFO’s primary responsibilities still include accounting, financial planning, forecasting, and compliance, these duties look different than they did just a few years ago—thanks to the rapidly evolving technological landscape. Now, CFOs must be able to use data-based insights to…

Read MoreHow Legal Entity Management Can Transform KYC Regulation Compliance and Optimize Client Onboarding

Ed Barrie In my decades of experience in treasury professional, handling KYC regulations and smoothing the client onboarding process were some of the greatest challenges I encountered — in large part due to the siloed and disparate nature of legal entity data. Gathering relevant entity information is vital to both processes, but with the…

Read More