Solving Treasury Complexity in Healthcare

When you think of critical roles within healthcare organizations, you probably think of doctors, nurses, and other medical staff. Treasury teams might not be the first thing to come to mind.

But behind the scenes, the treasury plays a pivotal part within the organization’s operations. In an industry under enormous financial pressure, maintaining a healthcare organization’s financial health is no small feat.

Treasurers are tasked with managing cash flow, ensuring liquidity, navigating complex banking structures, and more—while dealing with razor-thin margins and rising costs—all while supporting the delivery of quality patient care.

And many treasury teams are bogged down by legacy systems, manual processes, and fragmented data—making these tasks all the more difficult.

In fact, according to the 2021 HIMSS Healthcare Cybersecurity Survey, 73% of respondents were using legacy operating systems.

Fortunately, there are solutions to streamline operations and enhance treasury control. We’ll share some actionable insights in this article.

But first, let’s look at the uniquely difficult financial situation that healthcare treasurers must manage.

Why the Healthcare Industry is in Dire Financial Straits

Healthcare consistently ranks as one of the largest, most economically important industries in the United States—and it’s growing every year.

According to the Centers for Medicare & Medicaid Services (CMS), national health expenditures (NHE) grew by 7.5% in 2023 to $4.9 trillion. For context, this equates to 17.6% of the gross domestic product (GDP).

Yet, despite the sector’s sheer scale, healthcare organizations across the board are under massive financial strain.

According to a report by the American Health Association, this is due to several factors, from widespread inflation to insurer practices and underpayment to rising administrative, labor, and drug costs.

As a result, healthcare operators’ cash on hand dropped 28% between January 2022 and June 2023 (from 173 days to 124).

What’s more, according to the National Library of Medicine, the average hospital’s total liabilities represent a staggering 61% of its total assets, while the average profit margin is just 2.74%.

And while median net operating margins are on the rise, they were still just 4.3% in 2024, according to CommerceHealthcare—and they’re projected to stay low in 2025.

This data underscores the importance of the role of the treasurer in healthcare. With such slim margins and falling cash reserves, the need to make smart, nimble financial decisions is critical to hospitals’ operations.

Unfortunately, treasury operations in the healthcare sector come with added complications.

The Complex Nature of Healthcare Treasury Operations

With hundreds of locations, multiple legal entities, and numerous bank accounts, treasury teams must navigate a labyrinth of financial data. And as healthcare organizations grow, the complexity only multiplies.

Common challenges include:

- Managing the reporting of hundreds of locations and multiple legal entities

- Reconciling payments from various payers across multiple bank portals

- Manually posting cash receipts into ERP or EMR systems

- Tracking cash positions and forecasting using Excel spreadsheets

- Consolidating fragmented data for reporting and forecasting

- Complying with strict regulatory requirements such as HIPAA and SOX

- Managing restricted funds and donor contributions alongside operational cash flows

These manual workflows consume considerable time and resources. Worse, they increase the likelihood of inaccurate or outdated data. And they become increasingly unsustainable as organizations grow.

Automation is critical to get accurate, real-time financial insights, forecast cash flow, manage payments, and ensure that operations scale smoothly.

Treasury teams need a complete, real-time view of their financial position to optimize working capital and liquidity, reduce risk, stay compliant, and plan for the future.

That’s where modern treasury systems like Treasury4 come in.

Automation: The Key to Smoother Treasury Management

By implementing automated systems in treasury operations, healthcare treasurers can centralize data, eliminate repetitive tasks, and improve financial accuracy. Key benefits of treasury automation include:

- Real-time cash visibility: Automated platforms can consolidate bank accounts to give treasurers a complete, up-to-date view of cash positions.

- Faster reconciliation: Automated tools can also compare bank transactions with internal records, significantly reducing reconciliation time.

- Improved efficiency and error reduction: Automating data entry eliminates manual input errors, improving financial reporting accuracy and saving valuable time.

- Regulatory compliance: Automation ensures that reporting processes align with healthcare regulations and internal audit requirements.

- Scalability: Automation enables treasury teams to handle higher transaction volumes and support rapid growth.

A healthcare system managing hundreds of locations, for example, could cut reconciliation time from days to hours by automating cash matching and reporting. Additionally, automated workflows can generate compliance reports, helping healthcare organizations meet regulatory deadlines with much less effort.

Actionable Strategies for Implementing Treasury Automation

To fully capitalize on the benefits of automation, healthcare treasury teams should follow these steps:

Centralize Treasury Data

Select a treasury management system (TMS) like Entity4 to create a single source of truth for bank account data, payment platforms, and legal entities.

Synchronize data across ERP systems, bank portals, and other financial platforms through API integrations.

This will give you a unified view of treasury operations, improving reporting and decision-making. Plus, Entity4’s highly secure platform helps protect confidential patient information.

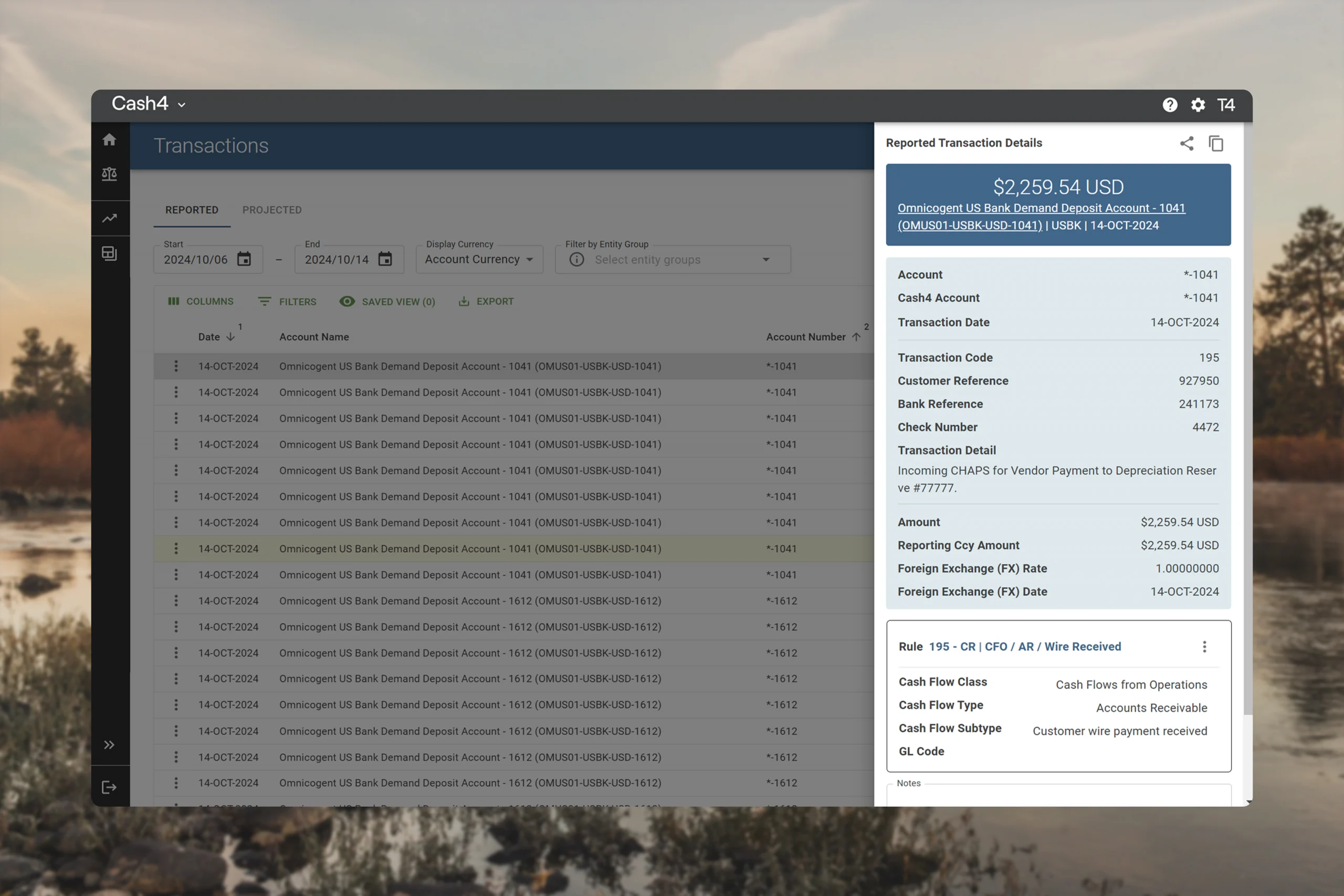

Automate Cash Reconciliation

Tools like Cash4 let you automate the process of matching bank transactions against internal payment records. You can use rules-based workflows to flag exceptions and reduce manual intervention. This frees up valuable time and resources for the organization to use on more important things—like growth plans and enhancing patient outcomes.

Enhance Cash Forecasting

Use predictive analytics and historical data to build rolling cash forecasts. Continuously refine forecasts based on real-time transaction data. Model various cash flow scenarios to assess liquidity risk and optimize working capital. For instance, if drug costs were to spike or inflation continues to outpace reimbursement, you can plan for those situations and how to manage your assets accordingly.

Streamline Payment Processes

Systems like Payments4 allow you to automate payment approvals, processing, and tracking across entities. You can implement standardized payment formats to improve efficiency. This can also help improve the patient experience, as it creates a simplified payment process.

Improve Compliance and Reporting

Automate regulatory reporting to ensure prompt submissions. Treasury4 lets you customize dashboards to monitor compliance metrics. It also maintains a built-in audit trail of all transactions and approvals. Most importantly, it ensures data security with SOC 2-compliant systems and encryption protocols.

By automating reporting and compliance, you can make sure regulatory issues don’t interrupt patient care services.

Key Takeaways and Next Steps

Healthcare organizations can no longer afford to rely on manual treasury processes. Automation improves efficiency, enhances accuracy, and provides the real-time insights needed to scale operations, manage cash effectively, and support high-quality care. To get started:

- Assess current treasury workflows to identify pain points

- Collaborate with stakeholders to define automation goals

- Research treasury management systems designed for healthcare needs

- Prioritize vendors that offer robust security features and regulatory compliance tools

By partnering with the right technology provider like Treasury4, healthcare treasurers can improve operational efficiency, reduce risk, and position their organizations for sustainable growth.

Healthcare organizations face enough challenges—treasury management shouldn’t be one of them.